A Dive into Fixed Rate Mortgages in the UK

17/01/2024 / By The MortgageHelp

The fixed rate mortgage stands as a pillar of stability in the ever-fluctuating landscape of the UK housing market. This article explores the features, benefits, and considerations associated with fixed rate mortgages, shedding light on why they remain a popular choice among homebuyers.

Understanding Fixed Rate Mortgages

A fixed rate mortgage is a home loan where the interest rate remains constant for a predetermined period, typically between two to ten years. This stability in interest rates provides borrowers with the assurance of predictable monthly payments, shielding them from the impact of interest rate fluctuations in the broader market. The average Interest rate across the UK for a 2 – year fixed rate is around 5.64%

What are the Key Features of Fixed Rate Mortgages?

Constant Interest Rates:

- The hallmark feature of fixed rate mortgages is the unchanging interest rate throughout the agreed-upon term.

- This stability allows borrowers to budget effectively, knowing their monthly mortgage payments will remain consistent.

Predictable Monthly Payments:

- Fixed rate mortgages offer a sense of financial security as homeowners can accurately anticipate and plan for their monthly expenses.

- This predictability is particularly beneficial for those on a fixed income or stringent budget.

Protection from Interest Rate Hikes:

- Borrowers are shielded from potential increases in interest rates during the fixed term.

- This can be advantageous in times of economic uncertainty or rising interest rate environments

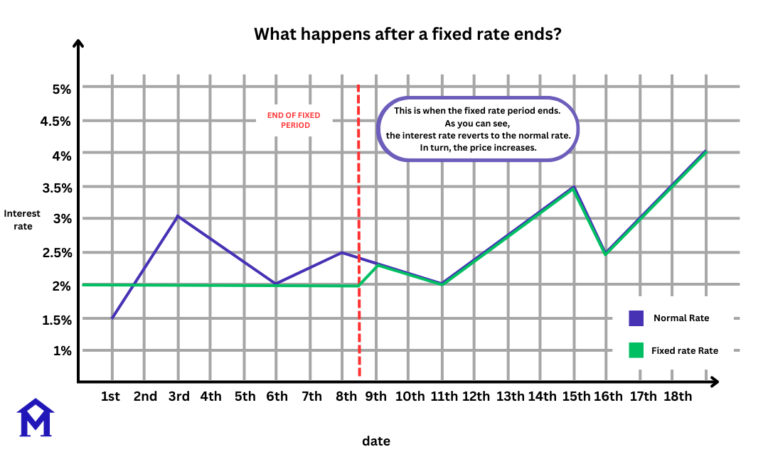

Above: The chart above shows what happens to a fixed rate after it expires. As you can seet the interest rate reverts to the standard variable rate after the period expires in turn this makes the monthly repayment increases.

What are the Benefits?

There are three main benefits to Fixed Rate Mortgages

Financial Certainty:

- The primary advantage is the peace of mind that comes with knowing the exact amount of each monthly mortgage payment.

- This stability facilitates better financial planning and budgeting.

Protection Against Market Volatility:

- Fixed rate mortgages insulate borrowers from the impact of interest rate fluctuations, providing a buffer against economic uncertainties.

Long-Term Planning:

- Ideal for individuals seeking stability over an extended period, fixed rate mortgages are conducive to long-term financial planning.

Predictable Equity Build-Up:

- As monthly payments remain constant, homeowners can confidently plan for the gradual accumulation of equity in their property.

Equity Build-up Calculator

Value of property after equity build-up:

Considerations for Fixed Rate Mortgages

1. Higher Initial Interest Rates:

- Fixed rate mortgages often start with higher interest rates compared to initial rates on variable rate mortgages.

- Borrowers pay a premium for the stability offered by a fixed rate.

2. Early Repayment Charges:

- Exiting a fixed rate mortgage before the agreed term may incur early repayment charges. Early repayment charges can vary between 1-5% depending on the amount time left.

- Borrowers should carefully consider their commitment to the chosen fixed term.

3. Limited Immediate Benefit from Interest Rate Decreases:

- If interest rates decrease after obtaining a fixed rate mortgage, borrowers may miss out on immediate reductions in their monthly payments.

Conclusion:

Fixed rate mortgages provide a solid foundation for homeowners seeking stability and predictability in their financial lives. As with any financial decision, it’s crucial for borrowers to carefully assess their long-term goals, risk tolerance, and current economic conditions. The choice between fixed and variable rate mortgages ultimately hinges on individual preferences and the desire for either stability or flexibility in the face of an ever-changing market.