Strategies for Securing the Best Mortgage Rates

21/01/2024 / By The MortgageHelp

Embarking on the journey to homeownership in the UK is an exciting yet intricate process, and one of the most crucial aspects is securing the best mortgage rates. The landscape is vast, with numerous lenders and a variety of mortgage products. In 2022, even after 900+ Mortgage Products were removed from the market due to increasing interest rates, 2,661 mortgage products remained. making the task seem daunting. However, with strategic planning and informed decision-making, you can navigate the UK mortgage market and ensure you obtain the best mortgage rates available. In this guide, we’ll delve into key strategies to help you achieve this financial milestone.

What are Mortgage Interest Rates?

A mortgage rate is the percentage of interest that a lender charges on the amount borrowed for a home loan. It represents the cost of borrowing money to finance the purchase of a property. Mortgage rates are a critical component of the overall cost of homeownership, as they directly influence the amount of interest paid over the life of the loan.

Mortgage rates can be either fixed or variable.

How to get the best mortgage rates?

1. Know Your Credit Score

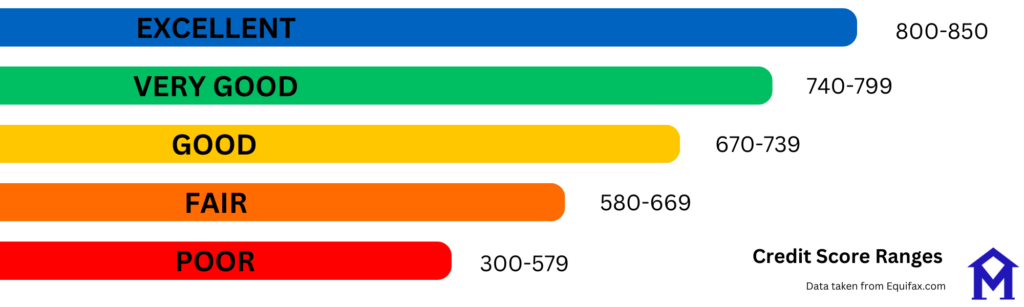

Your credit score is the foundation upon which lenders build their assessment of your creditworthiness. A higher credit score often translates to more favorable mortgage rates. On average, the average credit score across the UK is 631 according to Equifax, this is out of a total of 999. To obtain a copy of your credit report from a reputable credit agency, such as Equifax or Experian and review it for accuracy. If your score needs improvement, take proactive steps such as paying bills on time, reducing outstanding debts, and addressing any errors on your report.

The chart above shows the scale on which Equifax uses to categorize individuals’ credit reports. If you are at the higher end of the spectrum in the ‘Excellent’ bracket, you will be more inclined to have a mortgage accepted and maybe even offered better mortgage rates. Whereas, if you are in the poor category, you would be offered higher rates and maybe declined by certain lenders.

2. Research and Compare Lenders

The UK mortgage market is highly competitive, offering a plethora of lenders with diverse offerings. Don’t settle for the first option that comes your way. Conduct thorough research, compare interest rates, and consider the reputation and customer service of potential lenders. Online tools and mortgage comparison websites can be invaluable resources in this process, providing a comprehensive overview of available rates

3. Understand the Different Mortgage Types

Mortgages in the UK come in various types, including fixed-rate, variable-rate, and tracker mortgages. You can use wesbites such as Money Supermarket to help you compare mortgage rates. Each type has its advantages and disadvantages. Fixed-rate mortgages offer stable interest rates over a set period and are the most popular option for homeowners looking for low risk, providing predictability in monthly payments. Variable-rate mortgages, on the other hand, fluctuate with market conditions. Understanding each type will help you choose a mortgage aligning with your financial goals and risk tolerance.

4. Consider the Loan-to-Value (LTV) Ratio

Mortgages in the UK come in various types, including fixed-rate, variable-rate, and tracker mortgages. Each type has its advantages and disadvantages. Fixed-rate mortgages offer stable interest rates over a set period, providing predictability in monthly payments. Variable-rate mortgages, on the other hand, fluctuate with market conditions. Understanding the nuances of each type will help you choose a mortgage aligning with your financial goals and risk tolerance.

Use the below calculator to workout the Loan-to-Value of your property. simply enter the price of the property and how much you want to borrow. Most lenders prefer a lower LTV, as it shows less risk. The normal maximum LTV For lenders is 90-95%

Loan-to-Value (LTV) Calculator

5. Negotiate and Seek Professional Advice

Don’t hesitate to negotiate with lenders, especially if you have a strong financial profile. Professional mortgage advisors can also provide valuable insights and help you navigate the complexities of mortgage terms and conditions. Seeking expert advice ensures that you make well-informed decisions tailored to your unique financial situation.

Why use a Mortgage Advisor when I can do mortgage comparisons online?

Using a Mortgage Advisor provides several distinct advantages over relying solely on online mortgage comparisons. Mortgage Advisors offer personalized guidance tailored to your financial situation, helping you navigate through the complexities of mortgage options. They possess industry expertise, staying abreast of the latest market trends and lender offerings, enabling them to provide insights that automated online tools may not capture. Additionally, Mortgage Advisors can assess your unique financial profile, considering factors beyond interest rates, such as credit history and future financial goals, to recommend mortgage solutions aligned with your individual needs. Their expertise and personalized approach enhance the likelihood of securing a mortgage that not only suits your current circumstances but also aligns with your long-term financial objectives.

Conclusion:

Securing the best mortgage rates in the UK requires diligence, research, and strategic planning. By understanding your creditworthiness, exploring different lenders, comprehending mortgage types, managing your LTV ratio, and seeking professional advice, you can position yourself to obtain the most favorable mortgage rates available. Making informed decisions at each step of the process will not only save you money but also pave the way for a secure and financially sound homeownership journey.

This Article was AI assisted.