Understanding Interest Rates

17/01/2024 / By The MortgageHelp

Interest rates play a pivotal role in the economic landscape of any country, influencing borrowing, spending, and investment decisions. In the United Kingdom, interest rates are a key tool used by the Bank of England to manage inflation and support economic stability. This article aims to demystify interest rates in the UK, exploring their significance, how they are determined, and their impact on individuals and businesses.

What Are Interest Rates?

Interest rates represent the cost of borrowing or the return on investment for lenders. In the UK, the Bank of England sets the base interest rate, also known as the Bank Rate. As of writing, the current Bank rate is 5.29%. This rate influences the interest rates charged by commercial banks, affecting the overall cost of credit in the economy.

what does the Bank of England do?

The Bank of England’s Monetary Policy Committee (MPC) is responsible for setting the Bank Rate. The primary goal is to achieve the government’s inflation target, currently set at 2%. Inflation rate currently sits at 4%. The MPC considers various economic indicators, including inflation, economic growth, and employment, when deciding whether to raise, lower, or maintain the interest rate.

Types of Interest Rates:

Base Interest Rate:

- The Bank Rate, established by the Bank of England, serves as the guideline interest rate for commercial banks to work from. Adjustments in the Bank Rate send ripples across the financial system, influencing the interest rates associated with a range of financial products. The Bank of England change their Interest rates every 6 weeks.

Consumer Interest Rates:

Business Loans and Investments:

- Businesses also experience fluctuations in interest rates, affecting the cost of borrowing for expansion or investment. Higher interest rates may lead to reduced business spending, while lower rates can stimulate economic activity.

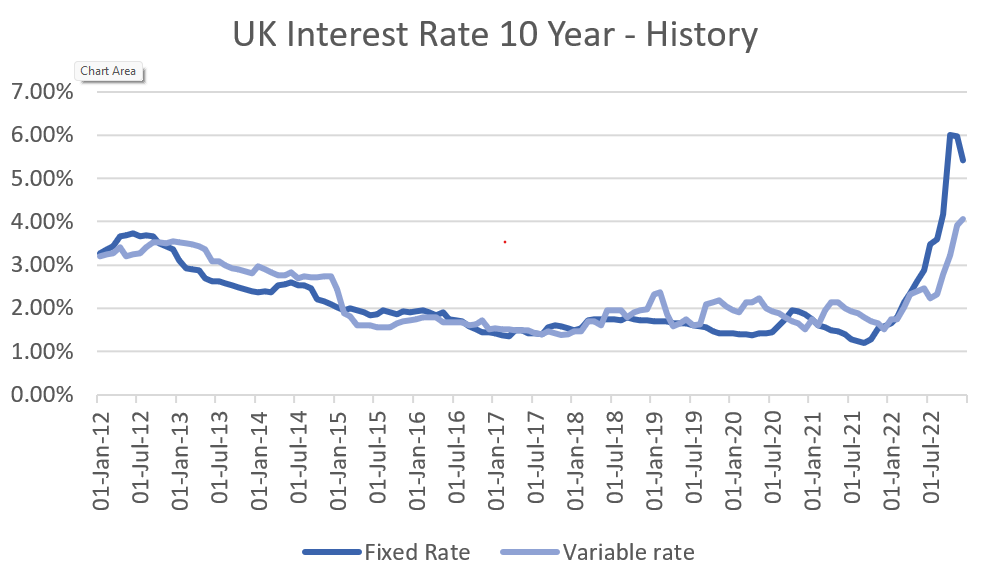

Above: 10 Year UK Interest Rate History Chart

What products are affected by interest rates?

Mortgages:

For homeowners, changes in interest rates can significantly impact mortgage payments. Rising rates may lead to increased monthly payments, while falling rates could result in potential savings. In 2023, interest rates rose from 0.1% to 5% which drastically increased mortgage repayments. Use the mortgage payment calculator below to work out your monthly mortgage repayments.

Mortgage Payment Calculator

Savings and Investments:

Savers and investors are affected by interest rate movements. Higher rates may offer better returns on savings accounts and investments, while lower rates can lead to decreased income for those relying on interest.

Impact on Businesses:

Cost of Borrowing:

Businesses often rely on loans for expansion and operations, In 2023, £450+ billion in business lending took place in the UK. Fluctuations in interest rates can affect the cost of borrowing, influencing business decisions and profitability.

Consumer Spending:

Consumer spending patterns are influenced by interest rates. Lower rates generally encourage spending, while higher rates may lead to reduced consumer borrowing and spending.

Conclusion:

Interest rates in the UK are a crucial aspect of the economic landscape, influencing the behavior of individuals, businesses, and financial markets. Understanding how interest rates are set, their impact on various sectors, and their role in economic stability is essential for making informed financial decisions in an ever-changing economic environment. Stay informed about economic indicators and the decisions of the Bank of England to navigate the dynamic landscape of interest rates in the UK.

This article was assisted by AI technology.