The Basics of Discount Mortgages

17/01/2024 / By The MortgageHelp

Discount mortgages in the UK offer an interesting option for people looking for affordable and flexible ways to buy a home. This article explores the features, benefits, and important factors related to discount mortgages, highlighting their usefulness in achieving the goal of owning a home.

What are Discount Mortgages?

A discount mortgage is a type of variable rate mortgage where borrowers enjoy a discounted interest rate off the lender’s standard variable rate (SVR) for a specified period. Unlike fixed rate mortgages, where the interest rate remains constant, discount mortgages offer borrowers the opportunity to benefit from a reduced interest rate, typically expressed as a percentage below the lender’s SVR.

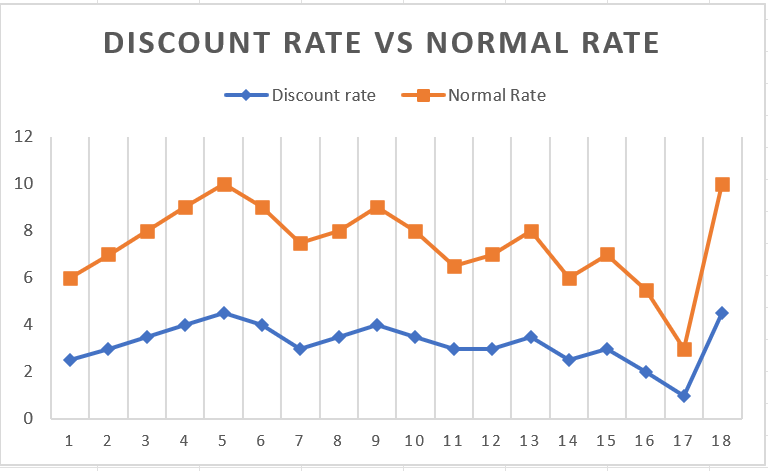

Above: Discounted rate is 4% below the Normal Rate

In the above chart, you can see how the discounted rate is 4% below the normal rate. As the normal rate fluctuates, so does the discounted rate. Owners of a discount mortgage can take advantage of low-interest rates as the normal rate drops, but they may also have to pay higher rates when the normal rate increases.

Key Features of Discount Mortgages :

1. Discounted Interest Rates:

- The primary feature of discount mortgages is the reduced interest rate offered to borrowers for a set period.

- The discount is applied to the lender’s SVR, allowing borrowers to enjoy lower monthly payments during the discounted period.

2. Variable Rate Structure

- Discount mortgages are a type of variable rate mortgage, meaning that the interest rate can fluctuate with changes in the lender’s SVR.

- Monthly payments may vary based on adjustments to the lender’s SVR.

3. Limited Duration of Discount:

- The discounted period is usually fixed, ranging from a few months to several years.

- After the discount period expires, the mortgage typically reverts to the lender’s standard variable rate.

What are the advantages of a Discount Mortgage?

Affordability During Discount Period:

- The discounted interest rates during the initial period make homeownership more affordable, especially for first-time buyers.

- Lower initial monthly payments can ease the financial burden in the early stages of the mortgage.

Potential for Savings:

- Borrowers can benefit from potential savings during the discounted period, allowing them to allocate funds to other priorities or investments.

- Savings are contingent on the duration of the discount and any changes in the lender’s SVR.

Flexibility and Transparency:

- Discount mortgages offer a degree of flexibility, as borrowers can take advantage of market conditions during the discounted period.

- The variable rate structure allows for potential reductions in monthly payments if the lender’s SVR decreases.

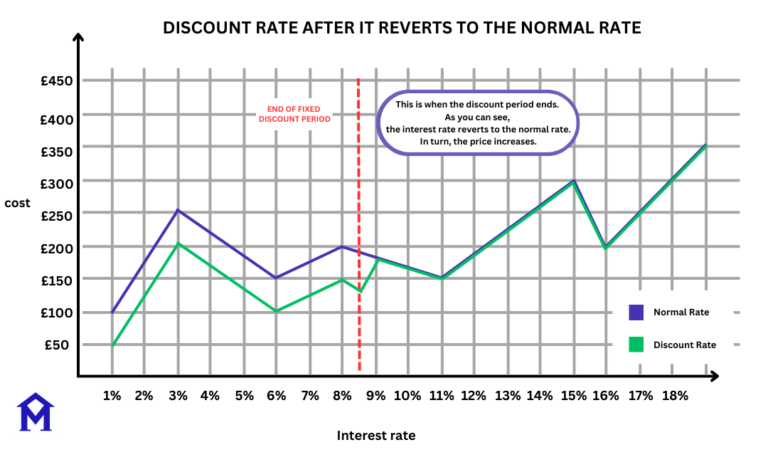

What happens when my discount period ends?

Once the discount period expires, the mortgage reverts to the lender’s SVR (Normal Rate), potentially leading to an increase in monthly payments. Borrowers should be prepared for adjustments and consider refinancing options if necessary.

Considerations and Potential Risks

Interest Rate Fluctuations:

- As discount mortgages are tied to the lender’s SVR, changes in the market or economic conditions can impact monthly payments.

- Borrowers should monitor interest rate trends and be prepared for potential fluctuations.

Early Repayment Charges:

- Exiting a discount mortgage before the end of the discounted period may incur early repayment charges.

- Borrowers should carefully assess their commitment to the chosen discount period.

Conclusion:

Discount mortgages in the UK provide a good mix of affordability and flexibility for homebuyers. When making financial decisions, it’s important for borrowers to think about their goals, tolerance for risk, and market expectations. Collaborating with mortgage advisors and staying informed helps individuals make smart decisions that match their specific situations, leading to a successful homeownership journey.

This article is AI assisted.