Standard Variable Rates : A Quick Guide to Avoiding Unnecessary Costs

17/01/2024 / By The MortgageHelp

For homeowners in the UK, the financial landscape is marked by various considerations, and one crucial aspect is the interest rate attached to their mortgage. With 62% of homeowners worrying about rising mortgage payments in 2022, it is crucial now more than ever that customers understand interest rates. The Standard Variable Rate (SVR) is a term that frequently surfaces in discussions about mortgage repayments. In this guide, we’ll unravel the intricacies of SVRs and outline strategies to steer clear of potential financial pitfalls.

Understanding Standard Variable Rates (SVRs):

What is an SVR?

A Standard Variable Rate (SVR) is the default interest rate set by a mortgage lender. Once a fixed-term or discounted-rate mortgage deal comes to an end, It becomes the baseline rate that borrowers revert to unless they opt for a new mortgage deal.

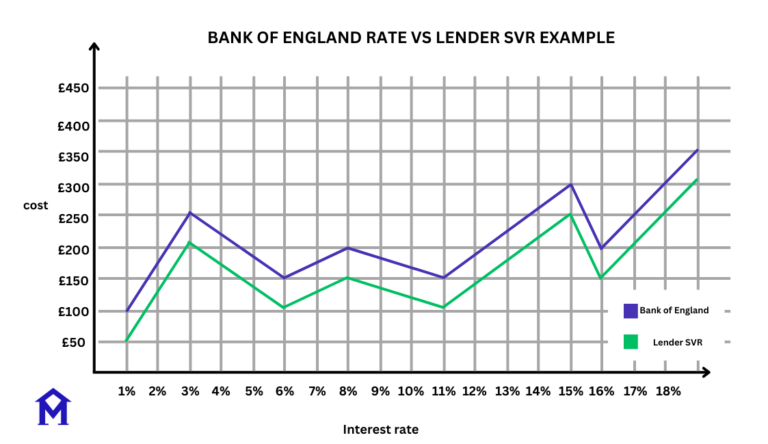

Above: A chart showing the relationship between a lenders Standard Variable Rate and the Bank of Englands Base rate. As you can see the Lenders SVR follows the Bank of Engands Rate with a lower interest rate. The current bank of england Interest rate sits at 5.25%

What are the Characteristics of Standard Variable Rates?

Variable Nature:

- SVRs can fluctuate based on changes in the Bank of England’s base rate or other factors determined by the lender, if the Bank of Englands interet rates go up, so would the Lenders.

Lack of Fixed Term:

- Unlike fixed-rate mortgages, SVRs do not come with a predetermined fixed term. Borrowers remain on the SVR until they take action to switch to a new mortgage deal or until their current one runs out. Depending on the Lender, the borrower can usually lock into a new deal 3 – 6 months prior to their fixed rate product expiring.

Individual to Each Lender:

- Each mortgage lender sets its own SVR, resulting in variations between lenders. Higher risk lending Lenders will have higher rates compared to lower risk lenders who will have low.

What are the Challenges Associated with SVRs?

Financial Uncertainty:

SVRs introduce an element of unpredictability to mortgage repayments. Fluctuations in interest rates can lead to variations in monthly payments, impacting homeowners’ financial planning.

Potentially Higher Costs:

SVRs are often higher than the rates offered during initial fixed-term deals. Remaining on the SVR for an extended period can result in higher interest payments meaning higher mortgage payments.

Strategies to Avoid SVRs:

1. Monitor Your Mortgage Deal:

- Keep a close eye on the terms of your existing mortgage deal. Note when it is due to end to avoid automatically moving onto the SVR. You can speak to one of our advisers here who will help you find your next best deal, or find out when your rate expires. Remember, lenders will usually allow you to secure a new deal 3-6 months prior to your fixed rate expiring.

2. Consider Remortgaging:

- Before your current deal concludes, explore remortgaging options. Securing a new deal can offer better interest rates, providing financial stability. Remortgaging can bring many benefits, such as reduced interest rates or higher overpayment facilities. For example, NatWest allows customers to make up to 20% overpayments each year without incurring any charges, where as most other lenders only allow 10%.

What is an overpayment?

An “overpayment facility” in a mortgage lets borrowers pay more than the agreed monthly amount as a percentage of the overall loan. This gives borrowers flexibility to put extra money toward lowering the loan amount or paying off the mortgage earlier than planned.

3. Seek Professional Advice:

- Consult with a mortgage advisor to explore suitable mortgage options based on your financial situation and goals. They can provide insights into the most advantageous deals available. Mortgage Advisors are also offered exclsuive rates, meaning you can sometimes get a better deal going through an adviser.

4. Understand Market Conditions:

- Stay informed about prevailing market conditions and potential changes in the Bank of England’s base rate. This awareness can guide your decision-making regarding when to switch mortgage deals.

Below: The current best mortgage Interest rates available to UK customers as of January 2024

5. Review Your Finances Regularly:

- Consult with a mortgage advisor to explore suitable mortgage options based on your financial situation and goals. They can provide insights into the most advantageous deals available.

6. Plan for Future Rate Changes:

- Consider future interest rate scenarios when choosing a mortgage deal. Opting for a fixed-rate deal can provide stability and protect against potential SVR increases.

Conclusion:

Understanding Standard Variable Rates (SVRs) may seem complex, but with careful planning, UK homeowners can steer clear of uncertainties. By actively managing their mortgage, exploring remortgaging options, and staying informed about market dynamics, they can navigate SVRs more confidently. Seeking professional advice and regularly reviewing financial circumstances are key parts of taking a proactive approach to mortgage management, empowering homeowners to stay in control of their financial destinies.