Exploring the Pros and Cons of Interest-Only Mortgages in the UK

19/01/2024 / By The MortgageHelp

Interest-only mortgages have been a topic of discussion and consideration in the UK real estate market for quite some time with over 700,000 mortgages in the UK being interest-only at the end of 2022. These unique mortgage products offer a distinct approach to homeownership, allowing borrowers to pay only the interest on the loan for a specified period, rather than making traditional monthly repayments that include both principal and interest. In this article, we will delve into the key features, advantages, disadvantages, and considerations associated with interest-only mortgages in the UK.

Understanding Interest-Only Mortgages:

Interest-only mortgages differ from standard repayment mortgages in that, during the initial term, borrowers are required to pay only the interest accrued on the loan amount. This means that monthly payments are lower compared to a repayment mortgage. However, at the end of the interest-only period, borrowers must repay the entire loan amount in a lump sum or convert the mortgage to a repayment structure.

Pros of Interest-Only Mortgages:

Lower Monthly Payments:

The primary attraction of interest-only mortgages is the lower monthly payments during the initial term. This can be particularly beneficial for individuals who need more flexibility in managing their cash flow. With the lower monthly payments, interest-only mortgages are a popular option for buy-to-let properties, as it allows the owner to increase the rental profit from the property.

Investment Opportunities:

Borrowers may choose interest-only mortgages with the intention of using the extra funds to invest elsewhere, such as in stocks, bonds, or other income-generating assets. This strategy, if successful, could potentially result in higher returns than the interest payments on the mortgage.

Affordability for Higher-Value Properties:

Interest-only mortgages can make it easier for borrowers to afford higher-value properties, as the lower monthly payments allow them to enter the property market without the immediate burden of repaying the principal.

Cons of Interest-Only Mortgages:

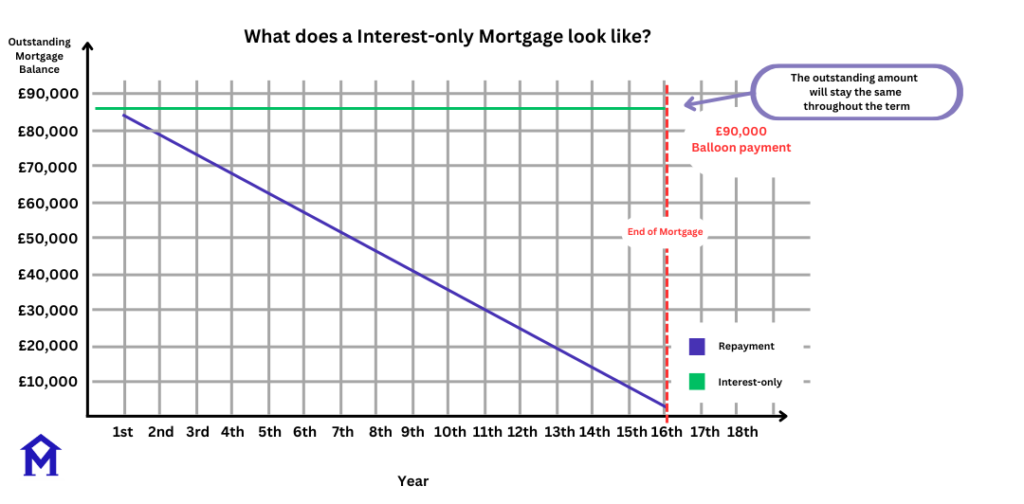

Balloon Payment Risk:

One of the significant drawbacks of interest-only mortgages is the ‘balloon’ payment due at the end of the interest-only period. Borrowers must be prepared to either pay off the entire loan amount or refinance the mortgage, which could pose challenges if property values have not appreciated or financial circumstances have changed. Most lenders may require a repayment vehicle/plan at the end of the term due to the increased risk before accepting an interest-only mortgage. Popular repayment vehicles are pensions or the sale of the property.

Above: An infographic showing the large ‘balloon’ payment required at the end of an interest-only mortgage.

Potential Negative Equity:

If property values decline during the interest-only period, borrowers may find themselves in a situation of negative equity, where the outstanding mortgage amount is higher than the property’s current value. This can complicate refinancing or selling the property.

Dependency on Investments:

Those who opt for interest-only mortgages with the intention of investing the saved funds must be mindful of the risks associated with investments. If the chosen investments underperform, borrowers may struggle to repay the mortgage at the end of the interest-only term.

Considerations for Borrowers:

Financial Planning:

Borrowers considering interest-only mortgages should engage in thorough financial planning to ensure they have a viable strategy for repaying the principal at the end of the interest-only period.

Market Conditions:

Monitoring property market conditions is crucial. Changes in property values can impact the ability to refinance or sell the property to cover the balloon payment.

Risk Tolerance:

Borrowers must assess their risk tolerance and financial stability. Interest-only mortgages carry inherent risks, and individuals should be prepared for unforeseen circumstances. A mortgage adviser will be able to help you work out your risk tolerance, you can find one here.

Who offers Interest-only Mortgages?

Interest-only mortgages are typically offered by banks, building societies, and specialist mortgage lenders. Some well-known providers include Barclays, Santander, HSBC, Nationwide, and Virgin Money. It’s always advisable to research and compare offers from various lenders to find the best option suited to your needs and financial situation.

Conclusion:

Interest-only mortgages offer a unique financial approach to homeownership in the UK, providing lower initial monthly payments and potential investment opportunities. However, the risks associated with balloon payments and market fluctuations require careful consideration. Borrowers should approach interest-only mortgages with a clear understanding of their financial goals, risk tolerance, and a well-defined plan for the future. Consulting with financial advisers and mortgage experts is essential to make informed decisions that align with individual circumstances and market conditions.