A Guide to Variable Rate Mortgages in the UK

17/01/2024 / By The MortgageHelp

In the dynamic landscape of the UK housing market, prospective homebuyers are faced with a range of mortgage options. One such option that offers flexibility and responsiveness to market changes is the variable rate mortgage. Being created over 90 years ago, the variable rate mortgage is a huge part of the mortgage market. This article delves into the basics of variable rate mortgages in the UK, exploring their features, benefits, risks, and factors to consider.

Understanding Variable Rate Mortgages:

Variable rate mortgages, also known as adjustable-rate mortgages (ARMs), are loans where the interest rate can fluctuate over the course of the loan term. Unlike fixed-rate mortgages, where the interest rate remains constant for the entire term, variable rate mortgages are tied to a reference interest rate, typically the Bank of England Base Rate.

Types of Variable Rate Mortgages:

Tracker Mortgages:

- Linked to the Bank of England Base Rate or another specified interest rate.

- The interest rate “tracks” the chosen benchmark, usually with a set percentage above or below it.

- Changes in the benchmark rate directly impact the mortgage interest rate.

- Offered at a discount to the lender’s standard variable rate (SVR).

- The interest rate fluctuates in relation to the lender’s SVR.

- The discount is usually for a fixed period, after which the mortgage reverts to the lender’s SVR. You can find out more about discount mortgages in this article here.

What are the Benefits of Variable Rate Mortgages?

There are three main benefits to Variable Rate Mortgages

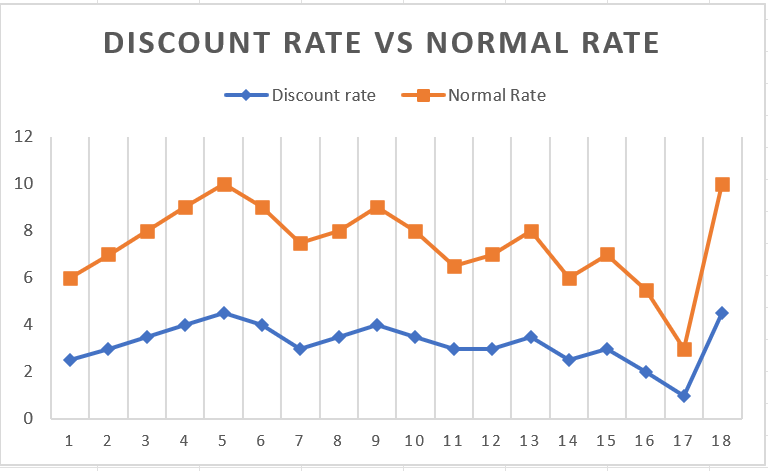

1. Initial Lower Interest Rates:

- Variable rate mortgages often start with lower interest rates compared to fixed-rate counterparts.

- This can result in lower initial monthly payments, making homeownership more accessible.

2. Potential for Savings:

- If interest rates remain stable or decrease, borrowers may benefit from lower mortgage payments.

- Savings can be significant over the life of the loan, especially during periods of low interest rates.

3. Flexibility:

- Variable rate mortgages often offer greater flexibility, allowing borrowers to overpay or pay off the mortgage early without facing hefty penalties.

Risks and Considerations:

Interest Rate Volatility:

- The main risk with variable rate mortgages is the potential for interest rate fluctuations.

- Changes in the reference interest rate can lead to increased monthly payments, impacting borrowers’ budgets. You can use the Mortgage Repayment Calculator below to work out how much your repayments would be.

Mortgage Repayment Calculator

Budgeting Challenges:

- Unpredictable changes in monthly payments can make budgeting more challenging.

- Borrowers should be financially prepared for possible increases in interest rates.

Market Uncertainty:

- Economic and market uncertainties can contribute to interest rate volatility.

- Borrowers should stay informed about market conditions and potential impacts on mortgage rates.

Long-Term Stability:

- Variable rate mortgages may not be suitable for those seeking long-term payment stability.

- Individuals who prefer consistent monthly payments may find fixed-rate mortgages more suitable.

Conclusion:

Variable rate mortgages in the UK offer a blend of flexibility and risk. Homebuyers should carefully assess their financial situation, risk tolerance, and market conditions before choosing this mortgage type. Staying informed about economic indicators and working closely with mortgage advisors can help borrowers navigate the ever-changing waters of variable rate mortgages, ensuring a well-informed and financially sound decision

This article was AI assisted.